By Thomas Carroll, REALTOR®

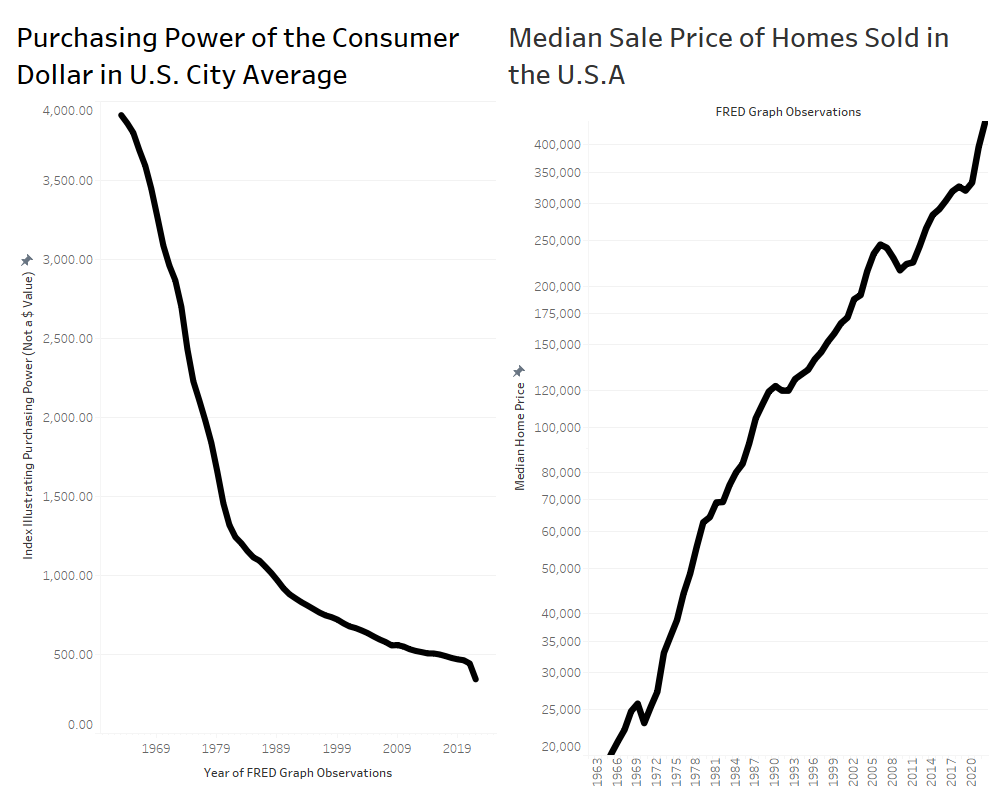

Today’s housing headline is that the Federal Reserve Bank of Dallas said their research suggests that home values could fall by as much as 20%. Headlines like this can be paralyzing and it very well could happen in the coming months. But let’s take a step back from the brink for a moment. If you are feeling paralyzed and unsure what to do I want to share these two charts with you.

On the left, you will see the declining purchasing power of the U.S. dollar over time. On the right you will see the appreciating, median home price in the U.S. over time. While these charts only show the past 60 years, this trend has been in place for well over a century. This trend has survived wars, recessions, a depression, pandemics and 18% mortgage interest rates. Throughout every crisis or recessionary period, regardless of when you bought, exchanging dollars for a home has been a good long-term strategy. The 2008 housing crisis, and all of the pain that came with it, looks almost irrelevant on this chart 14 years later. Permanently reversing the long-term trend of the declining purchasing power of the dollar and the appreciating home price shown in these charts would require significant structural, economic change. As long as we are living within this current trend, I will continue to buy and hold real estate and help others to safely do the same. So, if now might be the right time for you buy or sell, I would love to hear from you! Or if you just want to talk real estate, feel free to reach out. Thank you for reading!